By Alexander Yanchuk, owner of a consulting company, management consultant in the field of organizational development, lean manufacturing and quality management;

By Natallia Karnialiuk, junior researcher

Approach: stop repairing a cracked model

What used to be called insurance has long been broken. This is not new. The news is that it continues to be supported by crutches: CRMs, landings, ML alerts for fraud and other patches. As a result, a pseudo-digital process in which a manager who does not have time and accurate data decides anyway.

AI does not come as another tool. It comes as a challenge: either you rebuild the system, or it spreads to the state "we do not know what is happening." This is not a hypothesis, this is already an observable reality.

The Problem: AI Isn't Working Because It's Breaking Into a Mess

AI is not a separate module. This is a method of thinking. But most companies are trying to screw it to a system that barely holds without it.

No "bilingual"

Everything rests on people.

In one room is a data scientist who speaks the language of metrics and precision.

In another, an insurance expert for whom all these columns from Jupyter are noise.

Product in between. He has a release on Friday and bugs 34 pieces.

Result: there is a model, there is zero meaning in it.

2. Data - a lot, but they are dead

"We have the data.

"Are they marked?"

- No.

- Is there a unique client identifier?

- Well, there in 1C goes, plus Excel from the call center.

Typical history. Models without a training set are not models. It's imitation.

3. Legal fog

The standard in insurance is not ready for AI.

The model refused the client. Who will explain?

The model identified suspicious behavior. What to do: refusal, request, verification?

No company wants to be in court with the argument: "this is what the neural network said."

4. No system, there are only "puzzles"

AI is being implemented as a project. One is for fraud. The other is for retention.

The teams are different. The metrics are different. Architecture is none.

There is no single assembly point. AI is not end-to-end. He is point.

So - does not work. Because insurance is an end-to-end business.

The solution: not integrate AI, but build around it

If the approach does not change, nothing changes. It works only where AI is not a "tool," but the basis of the company's logic.

Not an MVP, but a hard priority

AI needs to be launched not where it is easier, but where it hurts more:

- settlement of losses (because it is expensive and long);

- predictive fraud (because real losses);

- outflow (because there is no second attempt).

Not "where to sell beautifully at a conference," but "where it falls apart every day."

2. Data architecture is not an IT challenge

It's a survival challenge.

If there is no data, the AI is just a pseudo-response generator.

We need:

- normalized display cases;

- track on quality and completeness;

- single customer identification;

- automatic markup of stories.

Without this, everything else is imitation.

3. Embed in process, not PowerPoint

If the model gives a signal, but the business does not see it, there is no model.

If the model affects, but the solution can be bypassed in Excel - there is no model.

AI needs to be part of the chain: from input to solution. Automatically. Without intermediaries.

4. The team is not a design, but a combat

Need a bunch:

- techies who can deploy, fix and explain;

- experts who know how real business works;

- managers whose KPI is not by release, but by effect.

And all this is not in parallel, but in one loop.

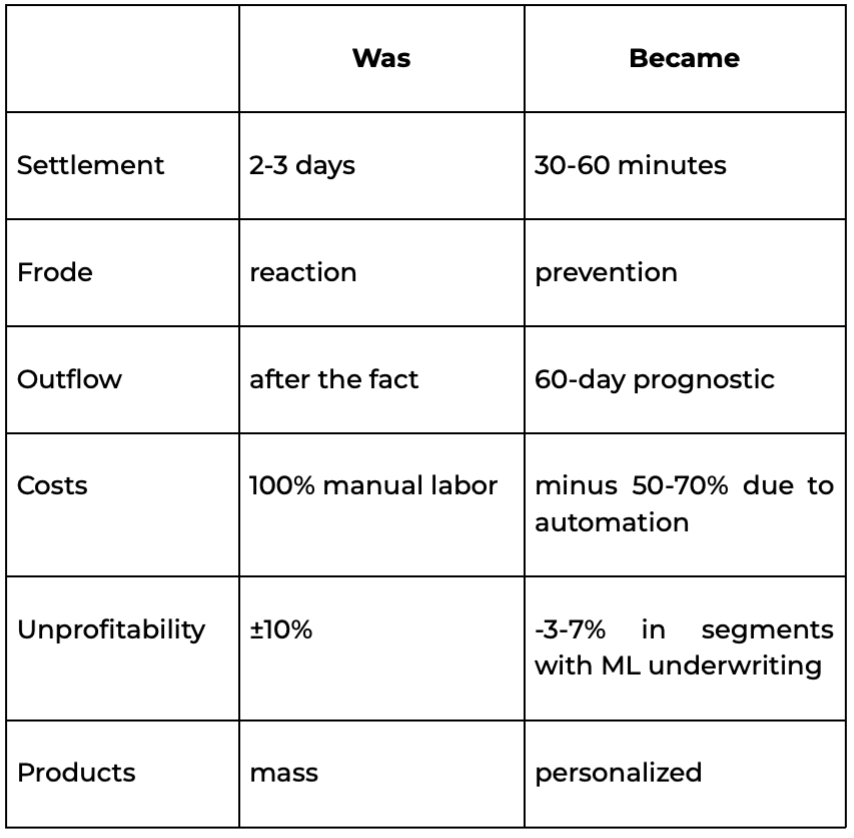

Results: What happens if not simulated

Where the AI is sewn into the system, and not "connected from the side," the effects are hard. Not cosmetic.

It's not because "AI is so smart." And because, finally, the system works as a system, and not as a set of manual protocols.

Sources (did not "check in Google," but worked with their hands)

- Real cases: Ping An (China), Lemonade (USA), AXA (EU), Zurich (Switzerland)

- Russian context: AlfaStrakhovanie, Sberbank, Ingosstrakh, RESO

- Closed discussions in product groups and AI workshops (2023-2025)

- Experience: integration of models into insurance chains, ML underwriting setup, DMS and OSAGO automation

- Research: McKinsey, BCG, EY, Accenture on AI in fintech and insurance

- Conversations with CPO, CDO, Head of Data in insurance that actually do, not write on LinkedIn